Understanding dental insurance can be tough. But knowing what you need to confirm your coverage is key. This article will help you get the right info to make sure your dental insurance works for you.

Key Takeaways

- Gather personal and employment details to verify your dental insurance eligibility.

- Understand the specifics of your dental plan, including deductibles, copayments, and covered services.

- Confirm the provider network and referral requirements to maximize your benefits.

- Learn how to submit claims and coordinate benefits with other insurance providers.

- Familiarize yourself with emergency dental care procedures and pre-authorization processes.

What Information Do You Need to Confirm Dental Insurance?

To confirm your dental insurance coverage, you need to gather some information. Make sure you have the dental insurance information required to confirm your dental coverage. Here’s what you’ll need:

- Your policy number

- Your group number

- The names of any dependents covered under your plan

- The effective date of your coverage

- Your plan deductible and annual maximum coverage

- The co-payment or coinsurance rates for different dental services

Knowing the details of your dental plan makes confirming coverage easier. Having this info ready helps you understand what you need. This way, you can make sure you get the dental coverage you deserve.

| Information Needed | Explanation |

|---|---|

| Policy Number | Unique identifier for your dental insurance plan |

| Group Number | Identifies the group or employer associated with your dental coverage |

| Covered Dependents | Names of family members included in your dental plan |

| Effective Date | The date your dental insurance coverage began |

| Deductible and Maximum | The amount you must pay before coverage begins and the annual limit |

| Copays and Coinsurance | Your share of costs for different dental services |

By gathering this dental insurance information required, you’ll be ready to confirm your dental coverage. You’ll also understand your dental plan better.

Understanding Your Dental Plan Coverage

Getting to know your dental plan can seem tough. But, knowing the basics can help you use your coverage wisely. Two key things to learn are dental insurance deductibles and copayments.

Deductibles and Copayments

Your dental plan coverage might have a deductible. This is the amount you pay first before your insurance kicks in. After you’ve paid your deductible, your insurance will cover a part of the cost. You’ll still have to pay a copayment or the rest yourself.

Knowing your deductible and copayment helps you plan your dental costs. This way, you can get the most from your dental insurance.

Covered Services and Exclusions

Your dental plan might cover many services, like cleanings and fillings. It could even cover more complex things like crowns or orthodontics. But, it’s key to check what’s not covered, or what might cost extra.

| Covered Services | Exclusions |

|---|---|

| Preventive care (cleanings, exams) Basic restorative care (fillings) Major restorative care (crowns, bridges) Orthodontic treatment | Cosmetic dentistry (teeth whitening) Experimental or investigational procedures Services not deemed medically necessary |

By knowing your dental plan coverage, you can make better choices about your dental care. This ensures you get the best value from your plan.

Gathering Personal and Employment Details

To confirm your dental insurance, you need your personal and employment details. This includes your name, date of birth, social security number, and contact info. Giving these details correctly can speed up the verification and make sure your dental coverage is set up right.

You also need to gather info about your job. This includes your employer’s name, your job status (full-time, part-time, or self-employed), and your employee ID, if you have one. These job details are key to checking if you’re eligible for dental insurance through your job.

| Personal Information | Employment Details |

|---|---|

| Full Name Date of Birth Social Security Number Contact Information (Phone, Email) | Employer Name Employment Status (Full-time, Part-time, Self-employed) Employee Identification Number |

Having this info ready can make confirming your personal information for dental insurance and employment details for dental coverage easier. Being prepared with the right details ensures a smooth and quick process when checking your dental insurance benefits.

“Accurate personal and employment information is the foundation for verifying your dental insurance coverage.”

What Info is Required to Confirm Dental Insurance?

To confirm your dental insurance, you’ll need to provide some important information. This includes personal and employment details, as well as other key pieces. These details help verify your dental insurance confirmation.

You’ll need your dental plan’s policy and group numbers. These numbers help your insurance provider find your plan quickly. If you have dependents covered, you’ll also need their names.

Knowing when your dental insurance started is also crucial. This includes any renewal or expiration dates. It ensures you’re using the right benefits and coverage periods.

| Required Information | Why It’s Needed |

|---|---|

| Dental Plan Policy Number | Identifies your specific insurance plan |

| Dental Plan Group Number | Helps locate your employer-sponsored plan details |

| Names of Covered Dependents | Ensures all eligible family members are included |

| Effective Date of Coverage | Verifies when your plan began and any renewal periods |

Having this required information to confirm dental insurance makes the process easier. It ensures your dental insurance confirmation details are correct.

“Knowing the key details of your dental plan can save you time and hassle when accessing your benefits.”

Verifying Provider Network and Referral Requirements

Understanding your dental insurance is key. Knowing about the provider network and referral rules is important. This part explains the difference between in-network and out-of-network dentists and how they affect your coverage.

In-Network vs. Out-of-Network Dental Providers

Your dental insurance plan has a list of preferred dentists, called in-network providers. These dentists have agreed on rates with your insurance. Visiting an in-network dentist means you pay less out of pocket.

Out-of-network dentists haven’t made deals with your insurance. You can still see them, but you’ll likely pay more. Your insurance might also pay less.

| In-Network Providers | Out-of-Network Providers |

|---|---|

| Negotiated rates with insurance | No negotiated rates |

| Lower out-of-pocket costs | Higher out-of-pocket costs |

| Preferred by insurance | Not preferred by insurance |

To get the most from your dental insurance, choose in-network dentists. Your insurance can give you a list of nearby dentists who are part of their network.

“Choosing an in-network dentist can save you a significant amount of money on your dental care.”

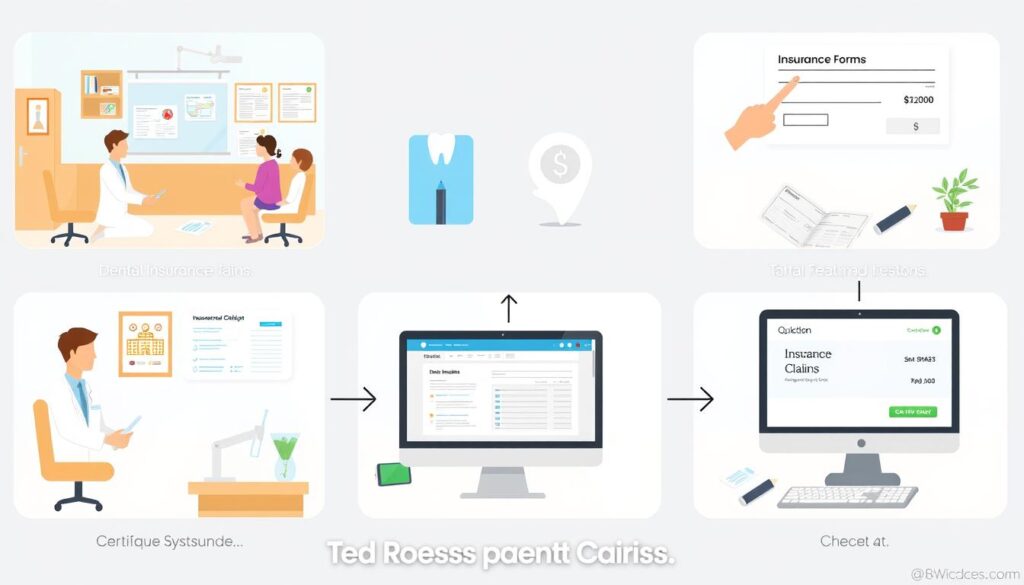

Submitting Claims and Reimbursement Procedures

After you know your dental insurance coverage, it’s time to learn how to submit claims and get reimbursed. This guide will help you through the steps to make the dental insurance claims process smoother.

First, get any needed pre-authorizations from your insurance before dental treatment. This step makes sure the services are covered and avoids surprise costs.

To submit a dental insurance claim, you’ll need to give details about the services you got. This includes the procedures, dates, and costs. Your dentist can usually submit the claim for you. But, it’s key to check the paperwork for mistakes before it’s sent.

| Necessary Information for Dental Insurance Claims | Benefits |

|---|---|

| Patient’s name and date of birth Dental procedure codes Dates of service Charges for each procedure Dentist’s name and contact information | Ensures accurate claim processing Expedites the reimbursement process Reduces the risk of claim denials Facilitates timely coverage of dental expenses |

After submitting your claim, keep an eye on its status for quick reimbursement. Most insurance providers have online portals or customer service for tracking claims. They can also explain any delays or denials.

“Staying informed and organized throughout the dental insurance claims process can help you maximize your coverage and minimize out-of-pocket expenses.”

By following the right steps for submitting claims and understanding the reimbursement process, you can make the dental insurance claims process easier. This ensures you get your dental expenses covered on time.

Coordinating Dental Benefits with Other Insurances

If you have more than one dental insurance plan, it’s key to know how to manage them. This can help you save money and get the most from your dental coverage.

Primary and Secondary Coverage

When you have two dental insurance plans, one is the primary and the other is the secondary. The primary plan pays most of your dental costs. Then, the secondary plan covers what’s left.

To figure out which plan is primary and which is secondary, look at a few things:

- Employment status: Your own employer’s plan is usually primary. If you have a plan through a spouse or parent, that’s secondary.

- Age: For kids, the parent whose birthday comes first in the year gets primary coverage.

- Disability or Medicare coverage: If you have a disability or are on Medicare, that plan is primary.

Knowing how to coordinate your dental insurance can save you money. It’s especially helpful when you need special or expensive dental care.

“Coordinating your dental insurance benefits can be a complex process, but it’s worth taking the time to understand how it works. This can help you save money and ensure you receive the care you need.”

Maintaining Accurate and Up-to-Date Records

Keeping detailed dental insurance records is crucial for getting the most from your dental benefits. It’s important to review and update your dental coverage information regularly. This ensures you’re using your plan to its fullest potential.

To keep your dental insurance info organized, follow these tips:

- Save copies of your insurance cards, policy documents, and any letters from your provider.

- Keep track of all dental visits, procedures, and costs. Note which services your plan covers.

- Check your explanation of benefits (EOB) statements to make sure claims are processed correctly.

- Update your personal and job details, like address or job changes, which might affect your coverage.

Confirming Dental Insurance

By managing your dental insurance records well, you can spot any errors or changes in coverage. This helps you make smart choices about your dental care. It also prevents unexpected costs and ensures you get the most from your dental plan.

“Keeping detailed records of your dental insurance coverage and claims history is the key to maintaining control over your dental expenses.”

Remember, your dental insurance is a valuable tool. By maintaining accurate and up-to-date records, you can move through the system confidently and smoothly.

Handling Dental Emergencies and Pre-Authorizations

Emergency Dental Care

Dental emergencies can happen anytime. It’s key to know how your dental insurance handles these situations. If you have a bad toothache, a tooth knocked out, or a broken dental piece, you need to act fast.

Your dental insurance might cover emergency care, but the specifics can differ. Some plans need pre-authorization for certain emergency treatments. Others might cover more if you see in-network dentists. Knowing these details helps you make smart choices and avoid surprise costs.

If you face a dental emergency, call your insurance right away. This step helps you get the right care and use your insurance wisely. It also helps keep your costs down.

Understanding pre-authorization for non-emergency dental work is also crucial. Many plans need approval for things like orthodontics, big restorations, or complex procedures. By knowing what’s needed and getting it done on time, you avoid delays and billing hassles.

| Dental Insurance Emergency Coverage | Dental Insurance Pre-Authorizations |

|---|---|

| Covers emergency dental services May require pre-authorization for certain procedures Higher coverage for in-network providers | Required for non-emergency dental procedures Ensures coverage for recommended treatments Streamlines the billing and reimbursement process |

Being proactive and knowing your dental insurance’s emergency and pre-authorization rules helps a lot. It lets you handle dental emergencies and non-emergency treatments confidently. This way, you get the care you need without breaking the bank.

Utilizing Online Resources and Customer Support

In today’s digital age, getting help for your dental insurance is easy. Insurance companies have lots of online tools and customer support to help you understand your plan.

Start by checking your insurance provider’s website. It’s full of useful info like your plan details, network providers, and how to file claims. You’ll also find educational resources, FAQs, and tools to help you manage your online dental insurance resources.

Insurance companies also have dental insurance customer support teams ready to help. You can call, email, or chat with them. They’re there to give you personalized advice and help you get the most from your dental insurance.

Using the resources your insurance company offers can help you manage your dental coverage well. You’ll stay up-to-date on policy changes and handle any issues that come up. Remember, your insurance company is there to help, so don’t be shy about reaching out.

| Online Dental Insurance Resources | Dental Insurance Customer Support |

|---|---|

| Insurance provider website Mobile app Self-service tools Educational resources FAQs and guides | Toll-free phone numbers Email support Live chat Social media channels In-person assistance |

“Utilizing the online and customer support resources provided by your insurance company can make managing your dental coverage a breeze.”

Confirming Dental Insurance

To confirm your dental insurance, you need to gather personal, employment, and plan details. Knowing what information you need makes it easier to get dental care. Keep your records up to date, use online tools, and ask for help when you need it.

Understanding your deductibles, copayments, and who’s in your network is key. Knowing these details helps you confirm your dental insurance smoothly. This way, you can move through the healthcare system confidently.

Being informed and proactive about your dental insurance is crucial. It helps you use your benefits well and keep your teeth healthy. With the right steps, you can handle dental insurance easily and focus on your dental health.

FAQ

What information do you need to confirm dental insurance?

To confirm your dental insurance, you’ll need some personal and work details. This includes your name, birthdate, social security number, and contact info. You’ll also need your employer’s info and your job status.

You might also need your dental plan’s policy and group numbers. Plus, the names of any dependents covered by your plan.

How do you understand your dental plan coverage?

Understanding your dental plan means knowing about deductibles, copays, and what services are covered. It also means knowing what’s not covered. This knowledge helps you make smart choices about your dental care and can save you money.

What information is required to confirm dental insurance?

Along with personal and work details, you’ll need your dental plan’s policy and group numbers. Knowing these details helps make the confirmation process smooth.

How do you verify the provider network and referral requirements?

Confirming your dental insurance also means checking the provider network and any referral needs. It’s important to know the difference between in-network and out-of-network providers. And, if needed, getting referrals to ensure your dental care is covered.

How do you submit claims and receive reimbursement?

After confirming your dental insurance, you’ll need to know how to submit claims and get reimbursed. This includes getting pre-authorizations, submitting claims, and tracking your reimbursement status.

How do you coordinate dental benefits with other insurances?

If you have more than one insurance plan, coordinating dental benefits is key. You need to figure out which plan is primary and secondary. And make sure your claims are managed well to avoid extra costs.

How do you maintain accurate and up-to-date dental insurance records?

Keeping your dental insurance records accurate and current is essential. This means having a detailed file of your policy, claims history, and any coverage changes.

How do you handle dental emergencies and pre-authorizations?

Dental emergencies can happen anytime. It’s important to know how your insurance handles these situations. This includes getting pre-authorizations for certain procedures and understanding emergency dental care coverage.

What online resources and customer support are available?

There are many online resources and customer support options to help with your dental insurance. Check your insurance provider’s website, mobile app, and customer service for help. These can answer your questions and address any concerns.

One Response